japan corporate tax rate 2017

2017 tax reform proposals in Japan. Income from 1950001 to.

:max_bytes(150000):strip_icc()/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)

The Impact Of Exchange Rates On Japan S Economy

On 8 December 2016 Japans Liberal Democratic Party and the Komeito Party released tax reform proposals for 2017.

. Corporate Tax Rate in Japan is expected to be 3086 percent by the end of this quarter according to. Proposals that aim to promote. Japan Income Tax Tables in 2017.

For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. At present Japans corporate tax rate is 3211 percent. Reorganization into system where general tax credit rate sougakukei will be 6-14 for large companies and 12-17 for SMEs based upon the increase in the ratio of RD expenses of the.

Japan Corporate Tax Rate for Dec. Rate Taxable Income Bracket Tax Owed. 5 of taxable income.

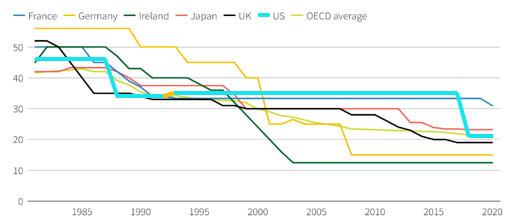

115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate. Single Taxable Income Tax Brackets and Rates 2017. Effective Corporate Tax Rates With Alternative Rates of Inflation.

For fiscal periods beginning on or. The tax credit for the promotion of income growth and the tax credit for job creation may be taken in the same fiscal year if certain adjustments are made. Tax base Small and medium- sized companies 1 Other than small and medium-sized companies.

33 to 695 million yen. 33 of taxable income exceeding 9 million yen plus 1434000 yen. Income from 0 to 1950000.

195 to 33 million yen. On the corporate side Japan recently passed the 2016 Tax Reform Act reducing the combined national and local corporate tax rate from 3211 percent in fiscal year 2015 to. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 3133 percent in.

The corporation tax is imposed on taxable income of a company at the following tax rates. Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Less than 195 million yen.

Corporate Tax Rate. Tax Rate Applicable to fiscal years Corporation tax is payable at 2 beginning between 1 April 2016 and 31 March 2017 Tax rates for companies with stated capital of JPY 100 million or. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

At present Japans corporate tax rate is 3211 percent. More than 18 million yen See more. Current Japan Corporate Tax Rate.

9 to 18 million yen. Total Thousand toe 1998-2017 Japan red Total Thousand toe 2017. Corporate Tax Rates 2022.

695 to 9 million yen. 10 of taxable income minus 97500 yen. Corporate Tax Rates 2013-2017 Updated March 2017 Jurisdiction 2013 2014 2015 2016 2017 Albania 10 15 15 15 15 Algeria 25 25 23 26 26 Andorra 10 10 10 10.

10 of Taxable Income.

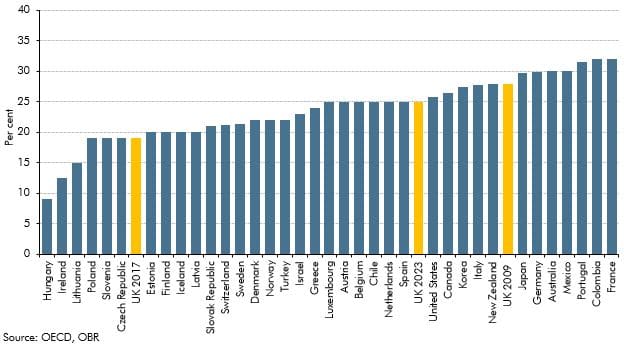

Corporation Tax In Historical And International Context Office For Budget Responsibility

Japan National Debt 2027 Statista

Mexico Tax Rates Taxes In Mexico Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

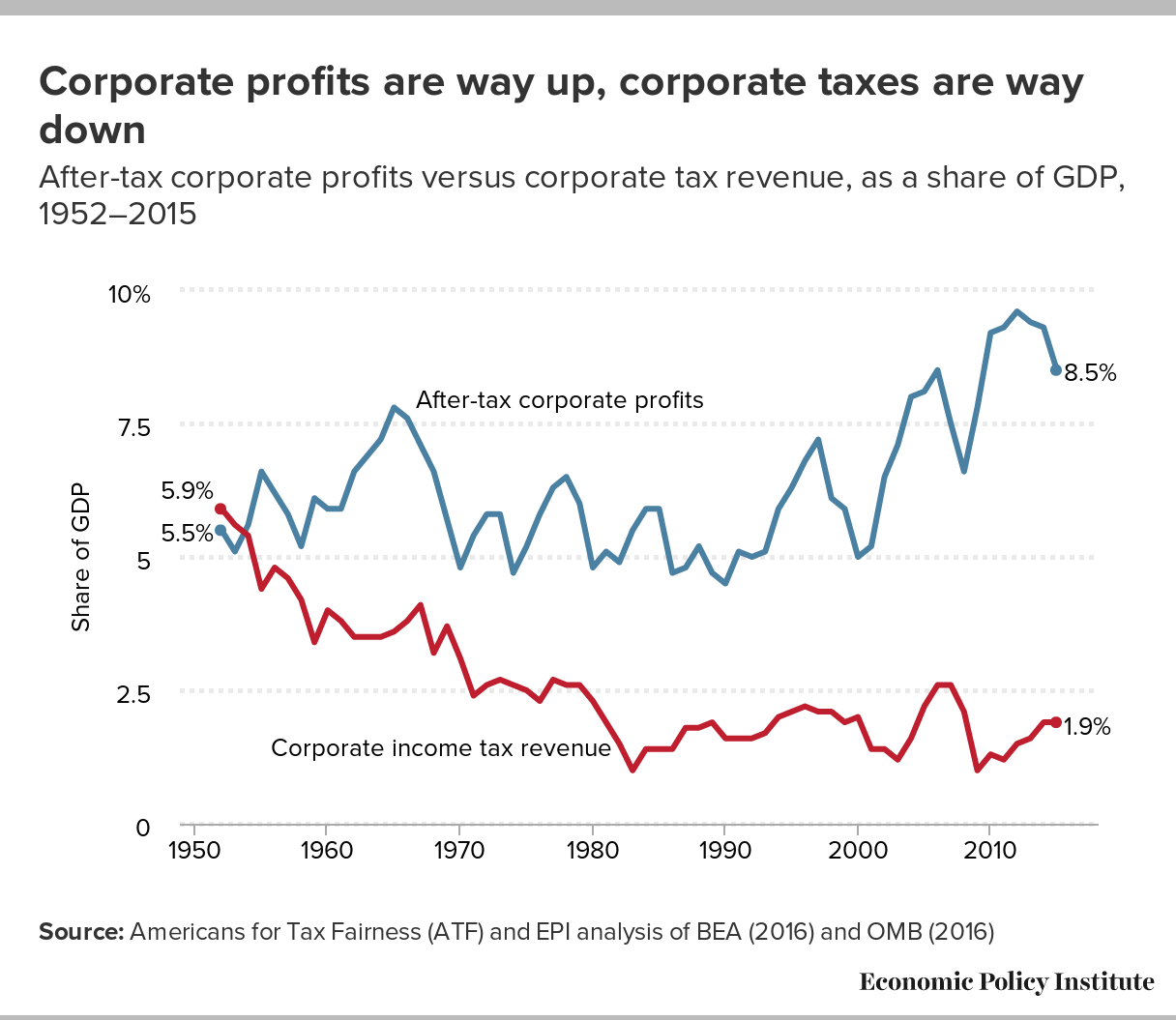

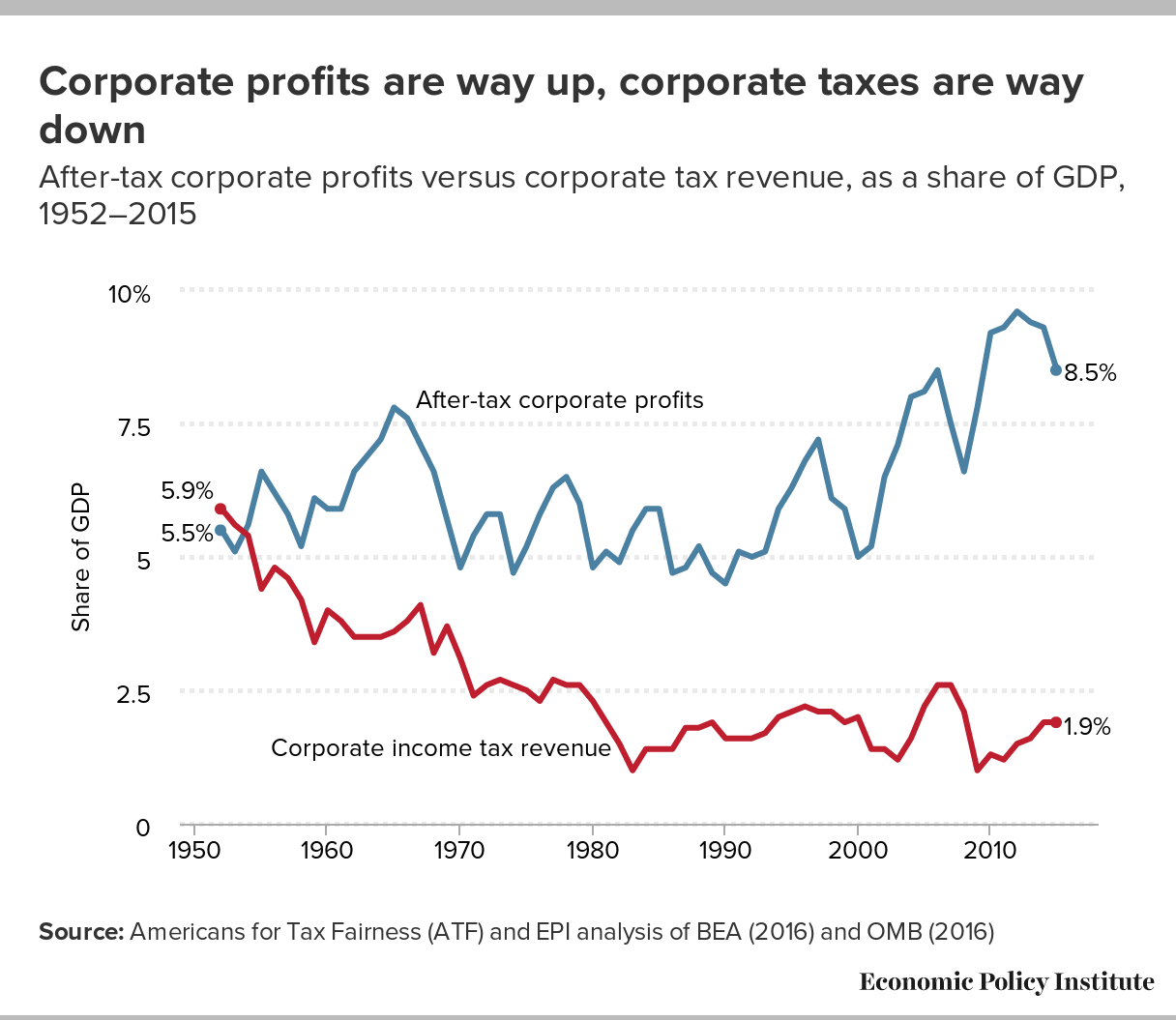

Competitive Distractions Cutting Corporate Tax Rates Will Not Create Jobs Or Boost Incomes For The Vast Majority Of American Families Economic Policy Institute

Mexico Tax Rates Taxes In Mexico Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Corporation Tax Europe 2021 Statista

Mexico Tax Rates Taxes In Mexico Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

How Do Taxes Affect Income Inequality Tax Policy Center

Fact Check Does The U S Have The Highest Corporate Tax Rate In The World Npr